macy's, Inc. ( M) is an omni-channel retail company that sells a range of merchandise such as men's, women's and children's apparel and accessories, cosmetics and other consumer goods. The company recently reported its Q4 FY 2013 financial results. The company's revenue during the last quarter of FY 2013 was $9.2 billion, down 1.6% in comparison to $9.35 billion in revenue during Q4 FY 2012 as well as the Wall Street estimate of $9.27 billion. However, the company reiterated its forecast for FY 2014, despite the decreased top line during Q4 of FY 2013. Therefore, I will analyze the company's FY 2013 top-line performance along with the initiatives the company is undertaking to improve its top line performance for FY 2014. I will also analyze the emerging trends in the retail industry to determine how the company's business model is well-aligned to those trends. This will indicate improvements in the company's top line in the coming years.

First, let us have a look at the company's top-line performance to date.

Top-line Performance Analysis

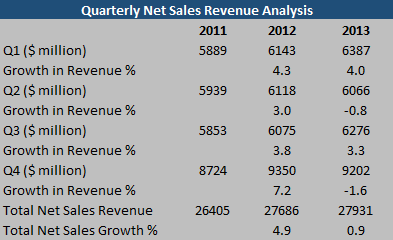

Source: M Quarterly Financial Results

The table above shows that the company recorded a 0.9% improvement in its total sales revenue for FY 2013. Q4 FY 2013 was the worst revenue performer since FY 2011 as the net revenue fell by 1.6% in contrast to Q4 2012. The company disclosed the fact that the harsh weather conditions and snow storms kept shoppers at home and was the reason behind the poor revenue performance of Q4 FY 2013. The fall in the sales in January hurt the overall sales of Q4 2013 and the snowy and cold weather in the U.S. forced 244 or 30% of the company's stores to close temporarily during January.

However, the company expects its business to normalize when the weather improves. The company's CEO expects customers to return to their usual shopping patterns once the weather gets warmer and spring merchandise reaches stores. The company has a full FY 2014 forecast for comparable sales growth of 2.5-3% while the company logged a 3.7% increase in full FY 2012 comparable store sales and a 1.9% increase in full FY 2013 comparable sales.

Now let us proceed in determining the future outlook of the company's top line.

Industry Trends for the CompanyAs per recent research, the millennials have become crucial to the U.S. retail industry. The millennials are the 82 million Americans who were born between the years 1985-2000. This generation is approaching an age that is forecast to change almost every feature of the U.S. economy. The millennials love to shop, spend around $600 billion per annum, and are projected to increase their retail spending to $1.4 trillion per annum by the year 2020. That would mean 30% of total retail sales in the region will be generated by millennials. The alteration in the industry is due to the fact that this group of people has different shopping habits that are savvier than their predecessors. They make their purchasing decisions based on social experiences and use online channels and phones to make their purchases. They have access to retailers around the globe and compare the prices and features of desired products in order to make an informed choice of what they need to buy.

As a result of this trend it is expected that around 15% of U.S. malls will be turned into non-retail space or fail totally within the next 10 years according to Green Street Advisors. Retail advisors forecast that 50% of America's retail centers will shut down within the next 15-20 years. Showrooms and retail outlets will experience the effects of "webrooming" meaning more and more consumers are window shopping online before coming to store and have an explicit idea in mind of what they want to buy. As a result, retailers and brands need to reform their supply chain strategies to match this shift in consumer demand.

Macy's Inc.'s omni-channel retail business model is in-line with evolving industry trends. This will benefit the company in the coming years as the forecasted change in the industry and consumer preferences outlined above will materialize.

Company's Omni-channel Business Model: In-line with Changing Industry TrendsOmni-channel retailing is the advancement of multi-channel retailing. It is more focused on a unified approach to the consumer experience, offering goods and services through all available shopping channels such as mobile internet devices, computers, television, direct mail, catalog and so on. In this retail model, the retailer trails the customers across all channels and becomes aware of the customer's desires and choices. As a result, marketing become more efficient with offers that address specific consumer preferences determined by purchase patterns, social network communication, website visits, and other data mining techniques. This enhances the consumer's experience through all channels and research shows that omni-channel shoppers spend 15-30% more in comparison to multi-channel shoppers and display strong brand loyalty, often swaying others to support a brand.

According to a global survey, just 7% of the survey population around the globe is extremely content with the omni-channel customer service offered to them by brands. The remaining population (87%) suggests that brands need to struggle harder to create a smooth customer experience. This means that there is room for improvement for other retailers and Macy's has directed its investments to further enhance its services.

Strategies that will Enhance the Company's Business Model and Top-line Closure of Stores and Other Strategies

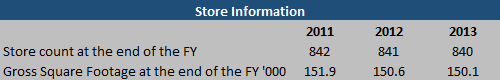

Source: M Store Information

The table above shows that the company has recorded a net decline in its store count and gross square footage during FY 2011-2013. Instead, the company is investing in enhancing its sales growth through strategies focused on maximizing the My Macy's localization initiative; improving the omni-channel business; and improving customer centricity, including appealing to customers on the selling floor through the MAGIC selling program.

Through the My Macy's localization initiative, the company has invested in talent, technology, and marketing that will ensure that core customers in each Macy's store finds merchandise and shopping experiences that are tailored to their needs. My Macy's has provided more local decision-making in every Macy's community. The chain stood out among its rivals during the economic downturn as it benefited from its strategies to tailor merchandise to local markets.

The company's omni-channel strategy allows customers to shop impeccably in stores, online, and via mobile devices. A crucial part of the company's omni-channel strategy is the company's capability to permit associates in any store to sell a product that may be unavailable locally by ordering merchandise from other stores or online fulfillment centers for delivery to the customer's door. The situation is also true vice versa as the company's online fulfillment centers can retrieve store inventories to satisfy online orders. On February 2nd, 2013, 292 Macy's stores were satisfying in-store and online orders from other stores. This is a rise from 23 Macy's stores using this strategy on January 28th, 2012.

The company has been investing heavily to beef up its e-commerce capabilities and has disclosed that it would spend about $1 billion on capital projects in FY 2013. The company has announced it was cutting jobs to carry out reorganization and support profitability. However, its total number of employees will remain around 175,000 since the company will add new staff in areas linked to online shopping. Sales from the company's internet business rose by 41.0% in FY 2012 and 39.6% in FY 2011.

Macy's MAGIC selling program is a strategy to enhance customer engagement and will also assist Macy's in better understanding the needs of customers, as well as to provide options and guidance. This inclusive and ongoing training program is designed to enhance the in-store shopping experience.

Final RemarksStifel Nicolaus analyst Richard Jaffe believes that Macy's is in a better position than most peers to gain market share in the coming years. This will be due to the fact that the company's business model and strategies have been altering the industry by focusing on customer trends and preferences. The emerging trend in the industry indicates the need for an omni-channel business model in the coming years to run successful retail businesses as customers prefer more analysis before shopping. This is because of more access to online platforms and is likely to decrease the need for brick and mortar outlets. As a result, the company is reducing its investment focus on stores and is investing more to enhance its online channels. Due to these factors, I can see the company's growth in the coming years and I believe that makes it a worthy investment.

No comments:

Post a Comment